Hello, friends. Welcome to our blog. My name is Max, and if this is your first time visiting our blog, then bookmark our site because we will constantly share articles that benefit you and your business Always make sure to visit our blog from time to time for important articles such as what we are about to share now.

Proven Money Saving Tips That Actually Work in 2025

Hello, dear friends, are you struggling to find money-saving tips that work in 2025? You’re not alone. Despite knowing better, nearly 2 in 5 employed Americans save less than 20% of their take-home pay, and shockingly, 27% of U.S. adults don’t have any emergency savings at all.

We’ve all been there, watching our paychecks disappear while wondering how to save money more effectively. The reality is sobering: 49% of Americans had $1,000 or less in savings as of late 2023, while the average household spends a whopping $219 monthly just on subscriptions. Unfortunately, this leaves 59% of people feeling uneasy about their current savings amount.

But there’s good news! Whether you’re looking for ways to save money quickly or clever methods to gradually build your financial cushion, we’ve compiled proven strategies that go beyond the obvious advice. From taking advantage of high-yield savings accounts offering over 4% APY to addressing the estimated $473 billion Americans waste annually on food alone, these practical tips will help transform your financial future.

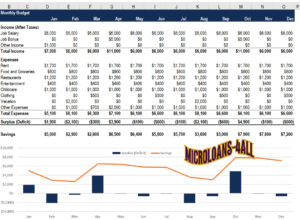

Create a Realistic Budget

A dollar without a purpose is a dollar easily lost. In 2025, creating a realistic budget remains the cornerstone of smart money management. Far from being restrictive, a well-crafted budget gives you control, allowing you to use your money intentionally and strike a balance between enjoying life now and securing your financial future.

-

Make a Budget That Fits Your Financial Reality

Effective budgeting begins with a thorough understanding of your financial circumstances. Start by calculating your net income, the amount remaining after taxes and deductions. Subsequently, track your expenditures over several weeks to gain an accurate view of your spending habits. This data provides the necessary insight to identify patterns and areas for improvement. With this information in hand, you can select a budgeting method that aligns with your financial objectives and personal preferences, ensuring a realistic and sustainable financial plan.

Fifty/Thirty/Twenty Rule: Allocate 50% of your income to essentials, 30% to discretionary spending, and 20% to savings or debt repayment

Envelope System: Divide your cash into physical envelopes assigned to specific spending categories

Zero-Based Budget: Assign every dollar a purpose so that your income minus expenses equals zero

Pay-Yourself-First: Automatically prioritize savings by setting aside money before covering other expenses.

Your budget should reflect your values and lifestyle, not be a one-size-fits-all solution. Choose the method that helps you stay consistent and feel in control.

-

Tools to help you budget

Technology makes tracking your finances easier than ever. Mint (now on Credit Karma) allows you to link accounts from more than 17,000 financial institutions to view all transactions in one place. Goodbudget uses the virtual envelope method to keep you on track. Monarch Money offers customizable budgeting with two approaches: simple “Flex” budgeting with three buckets or detailed category-based budgeting.

For couples, Honeydue allows both partners to sync accounts and set spending limits together. YNAB (You Need A Budget) uses zero-based budgeting to make you more intentional with your money.

-

Why budgeting is the first step to saving money

Budgeting helps you control spending by spreading your income across your most important expenses. Furthermore, it reveals which purchases are essential and which are discretionary, allowing you to reallocate funds toward bigger goals. As a result, you’re less likely to need credit cards or loans to stay afloat.

Creating a budget also helps you balance present concerns with future aspirations. You can establish separate savings accounts for emergency funds, vacations, and down payments. Consequently, you gain financial confidence knowing you can handle unexpected expenses without taking on debt.

Setting specific savings goals transforms vague financial hopes into achievable targets. When you identify exactly what you’re saving for, your money has purpose and direction, making you more likely to follow through.

-

Short-Term vs. Long-Term Savings Goals

Financial goals are commonly categorized based on their time horizon. Short-term goals, typically targeted within one to two years, may include building an emergency fund, financing a vacation, or purchasing a vehicle. Mid-term goals, spanning roughly one to five years, often involve saving for a home down payment or undertaking major home renovations. Long-term goals, which extend beyond five years, include objectives such as retirement planning, funding a child’s education, or paying off a mortgage.

The appropriate place to hold your funds depends largely on the timeframe. When you’re thinking about your financial goals, it’s important to choose the right types of investments to suit your timeline. For those short-term goals, say in the next 18 months, consider putting your money into high-yield savings accounts or certificates of deposit (CDs). They’re low-risk options that keep your funds both secure and accessible when you need them.

If your goals are a bit more mid-range, around 18 to 36 months, money market accounts or short-term bonds can be a good fit. They strike a balance between safety and earning some interest without too much risk.

Now, for those longer-term goals, which are five years or more down the line, think about growth-oriented investments. Stocks, mutual funds, or index funds can be quite effective here. Since you have a longer time frame, you can better weather any market ups and downs, giving your investments a chance to grow significantly.

-

How to calculate your savings target

Initially, make your goals SMART—specific, measurable, achievable, relevant, and time-bound. Instead of “save for vacation,” try “save $2,000 for a Florida trip by June 2025”.

Next, calculate your monthly savings requirement. If you need $6,000 in three years, you’ll need to save approximately $167 per month. Use savings calculators to factor in interest rates—with a 4% APY account, saving $6,000 in one year would require about $490 monthly.

-

Tracking Progress Toward Your Goals

Monitoring your savings progress regularly is crucial for maintaining both motivation and accountability. Many financial institutions now provide integrated goal-tracking tools within their online and mobile platforms. Alternatively, utilizing a straightforward spreadsheet can serve as an effective means to track your progress toward specific financial objectives.

Dividing larger goals into smaller, achievable milestones can significantly enhance the journey’s attainability. For instance, if your goal is to save $1,000, recognizing each $250 milestone can foster a sense of accomplishment and help maintain your momentum.

It is advisable to conduct a review of your progress monthly, allowing for adjustments to your plan that reflect any changes in your financial circumstances. Even small, consistent contributions can make a meaningful difference. The essential principle is to remain focused and continue progressing steadily toward your objective.

Knowledge is power when it comes to your finances. Tracking where every dollar goes illuminates your spending patterns and empowers you to make informed decisions about your money.

-

Why tracking spending matters

Consistently monitoring your expenses delivers multiple benefits for your financial health. First, it helps you stick to your budget by allowing real-time decisions when you’re approaching spending limits. Additionally, tracking creates awareness of spending patterns, making it easier to identify areas where you can cut back.

Monitoring expenses throughout the month helps you avoid debt by ensuring you spend less than you earn. Moreover, when you know where your money goes, setting realistic savings goals becomes significantly easier.

Tracking expenses throughout the year also simplifies tax preparation, potentially accelerating your refund. Having clear visibility into your finances reduces anxiety about unexpected expenses.

-

Apps and tools to monitor expenses

Technology makes expense tracking more convenient than ever. Many budgeting apps automatically sync with your bank accounts, categorize transactions, and provide visual insights into your spending patterns.

Apps and Tools to Track Your Spending

Thanks to technology, keeping tabs on your expenses has never been easier. Modern budgeting apps can automatically sync with your bank accounts, categorize your transactions, and provide clear, visual breakdowns of your spending habits.

Here are a few popular options:

- Mint / Credit Karma – Syncs with over 17,000 financial institutions to provide a full financial snapshot

- YNAB (You Need a Budget) – Uses a zero-based budgeting approach to help you plan every dollar

- Monarch Money – Combines flexible budgeting with detailed category tracking for personalized money management

- Honeydue – Built for couples, allowing both partners to view and manage finances together

Although many budgeting apps provide free versions, unlocking advanced features typically requires a subscription, usually costing between $1 and $15 per month. To find the best fit, select an app that complements your budgeting approach and take advantage of any free trial offers to explore its features before making a financial commitment.

- How to identify spending leaks

Consistency is the secret ingredient to successful saving, and automation makes consistency effortless. By removing decision-making from the equation, you can build wealth silently in the background while focusing on living your life.

-

How automation helps you save consistently

Automatically transferring money to savings creates a “pay yourself first” habit that ensures saving happens before spending. Studies show regular automated transfers increase savings goal achievement by 1.5 to 3.5 times compared to manual methods. Essentially, automation removes the mental hurdles that often prevent saving—you’ll never forget to save or be tempted to spend that money elsewhere.

Even small, consistent deposits compound significantly over time. While it might feel more satisfying to make occasional large deposits, regular automatic contributions build wealth more effectively through compounding interest. Subsequently, you’ll develop better overall financial habits since having less money in your checking account naturally encourages more mindful spending.

Best tools to automate savings

There are several effective strategies to automate your savings and cultivate them as a consistent practice:

- Automatic Bank Transfers:

Think about setting up a simple routine to boost your savings. By scheduling transfers from your checking account, you can make saving feel effortless. It often works best to align these transfers with your payday or pick a regular schedule that fits your lifestyle.

- Round-Up Apps:

Have you considered using apps like Acorns? They do a neat trick by rounding up your daily purchases to the next dollar, saving or investing that little extra change for you. It’s an easy and automatic way to grow your finances without even thinking about it!

- Intelligent Savings Apps:

Applications such as Oportun (formerly Digit) can analyze your spending patterns and automatically allocate small, manageable amounts into your savings without requiring your active involvement.

- Bank Automation Features:

Many financial institutions offer built-in tools to facilitate automatic savings. For example, Chime allows you to designate a fixed percentage of your paycheck to be saved automatically.

These options enable you to enhance your savings seamlessly while you concentrate on your day-to-day activities.

- Setting up direct deposit to savings

Perhaps the most powerful automation method is splitting your direct deposit between checking and savings accounts. According to research, this approach results in higher monthly savings (averaging $167.84) than contingent savings methods ($80.36).

- To set up direct deposit splitting:

Contact your employer’s payroll office or visit their online portal

Complete a direct deposit form with your account/routing numbers

Specify the amount or percentage to deposit into each account

- Monitor your accounts to confirm proper setup

By using these automation techniques, you’ll create an effortless system that builds wealth while you sleep, turning saving from a chore into a habit.

-

Pay Yourself First

Financial wisdom has long emphasized one strategy above all others: pay yourself first. This approach flips traditional money management on its head, fundamentally changing how you view saving.

- What does it mean to pay yourself first?

“Pay yourself first” means treating savings as your top financial priority—even above bills and living expenses. Specifically, you set aside money for savings immediately after receiving your paycheck, before spending on anything else. Unlike traditional budgeting, where you save whatever remains after expenses (which often results in saving nothing), this method ensures consistent saving by making it your first financial action.

The concept transforms saving from an afterthought to a non-negotiable priority. Ideally, you should aim to save 5-10% of your take-home pay initially, gradually increasing to 20% as you adjust your spending habits.

-

How to prioritize savings over spending

- Implementing this strategy requires several practical steps:Review your budget to identify areas where spending can be reduced

Calculate your savings target based on your financial goals

Determine a specific amount to save from each paycheck

Consider an 80/20 approach where 20% goes to savings and 80% to expenses

Decide where to direct your savings based on priorities (emergency fund, retirement, specific goals)

Notably, if you’re struggling with high-interest debt, you might need to balance paying yourself first with debt reduction. Otherwise, focus on building an emergency fund of 3-9 months’ expenses as your first savings priority.-

Making it a habit

Particularly effective ways to cement this habit include:

Set up split direct deposits where a portion of your paycheck automatically goes to savings. Alternatively, schedule automatic transfers from checking to savings accounts on payday. Treat these savings as completely off-limits except for their intended purpose.

Even if you start small, the key is consistency. Whenever you receive additional money like tax refunds or bonuses, commit to saving a portion of those funds as well.

- Cut Unnecessary Subscriptions

-

Subscription services can quietly chip away at your budget without you even noticing. A recent survey found that the average American spends about $77 each month, or $924 per year, on subscriptions. What’s more surprising is that most people underestimate their monthly subscription spending by roughly $133, highlighting how easily these costs can slip under the radar.

YThe Money Saving Challenge That Actually WorksOUR TEXT

YOUR TEhttps://microloans4all.com/why-many-start-up-businesses-dont-succeed/XT

To regain control of your subscription spending, conduct a thorough audit:

-Gather your statements – Review bank and credit card statements from the past three to six months. Don’t forget to check PayPal, Venmo, and app store subscriptions.

-Create a master list – Document every recurring charge, including service name, cost, and billing frequency.

- Categorize each subscription – Honestly assess each service as:

Essential (necessary for daily operations)

Valued (enhances quality of life, used regularly)

Nonessential (rarely used or forgotten services)

Make elimination decisions – Cancel anything you haven’t used in the last three months. Consider downgrading premium services if standard tiers would suffice.

- Apps that help cancel unused services

Several tools can simplify subscription management:

Rocket Money finds and tracks subscriptions automatically, offering a cancellation assistant service to handle terminations on your behalf. Other options include Bobby, Hiatus, and PocketGuard.

Nevertheless, be cautious—many subscription management apps charge fees or require access to your financial data. Some offer free subscription tracking but require payment for cancellation services.

-

Monthly savings potential

The financial impact of cutting unnecessary subscriptions can be substantial. Nearly 50% of people admit to paying for streaming services they hardly or never use. Common subscription culprits include:

Unused gym memberships

Overlapping streaming services

Software subscriptions for rarely used apps

Premium dating services with features available on free platforms

By regularly auditing your subscriptions (ideally every six months), you could potentially save $600 annually. One family discovered they could save $2,370 yearly just by renegotiating existing services.

Remember to set calendar reminders before annual renewals—many services count on you forgetting to cancel before auto-renewal kicks in.

- Pack Your Lunch

Brown-bagging your lunch represents one of the most underrated yet powerful money-saving habits. The financial impact of this simple daily choice extends far beyond loose change.

-

Cost comparison: eating out vs. packing lunch

The difference in cost between dining out and eating at home is striking. On average, a meal at an inexpensive restaurant costs about 285% more than a homemade one $16.28 compared to just $4.23. For those working in city centers, the disparity is even greater, with restaurant meals often topping $15, while packing a lunch from home can cost as little as $3.

In real terms, Americans spend roughly $3,000 annually on lunches alone. Buying a $10 lunch five days weekly costs $2,450 yearly, essentially consuming one entire after-tax paycheck for someone earning $75,000 annually.

-

Meal prep ideas for busy people

Meal preparation needn’t be time-consuming. Consider these efficient approaches:

Batch cook proteins like shredded chicken and staples such as rice on weekends

Repurpose dinner leftovers into next-day lunches

Utilize affordable ingredients like beans, rice, and seasonal vegetables

Prepare cold salads with protein and fiber that last several days

Leverage store-bought rotisserie chicken, canned tuna, or beans for no-cook options

Simultaneously, plan your calendar to accommodate meal prep. Many find success dedicating Saturday or Sunday mornings to gathering recipes and grocery shopping for the upcoming week.

-

How does this habit add up over time?

The long-term financial impact is substantial. Packing a $3 lunch instead of purchasing a $15 meal saves approximately $2,940 annually. Coupled with saving time (no driving to restaurants), this habit creates multiple benefits.

Beyond that, home-prepared meals typically contain 200 fewer calories than restaurant options, making this habit beneficial for both your wallet and waistline. In essence, this single change could potentially fund a vacation, boost your emergency fund, or accelerate debt payoff within just one year.

For this reason, many financial experts consider lunch-packing among the highest-ROI money-saving strategies available to the average person.

Although finding effective money-saving strategies might seem challenging in 2025, these proven tips demonstrate that financial security remains within reach for anyone willing to take action. Building wealth starts with creating a realistic budget that aligns with your specific lifestyle and priorities. Subsequently, setting clear savings goals gives your money purpose, while tracking expenses reveals exactly where every dollar goes.

2 Comments